Trading the DAX Profitably Using Seasonal Chart Patterns

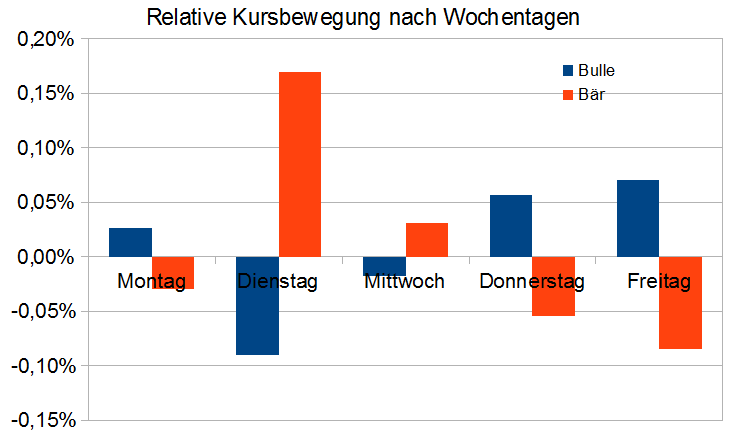

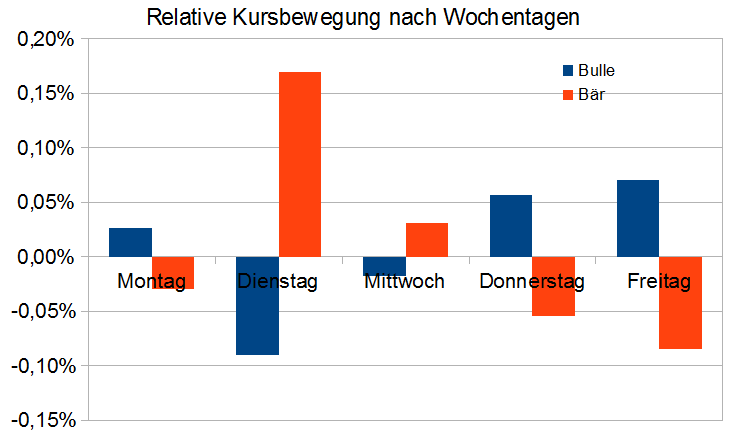

Are there typical patterns for the daily change of the (F)DAX depending on whether we are in a bear or bull market? The daily change is defined here as the percentage difference between the market opening at 8:00 a.m. and the market close at 10:00 p.m. The result is astonishing:

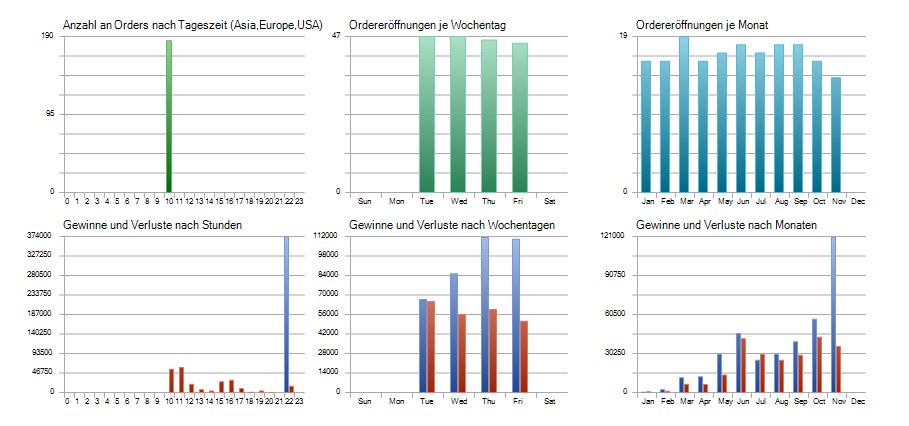

We can immediately see a striking and clear relationship. In a bull market, prices tend to rise on Monday, Thursday, and Friday, while they tend to fall on Tuesday and Wednesday. In a bear market, it is exactly the opposite. So, if you are looking for a buy signal in a bull market, you should rather enter towards the end of the week and definitely avoid Tuesday. The question of “why” is of course interesting but purely speculative. You could come up with great stories here, but what’s more interesting is: can we actually turn this statistical edge into a real profit advantage?

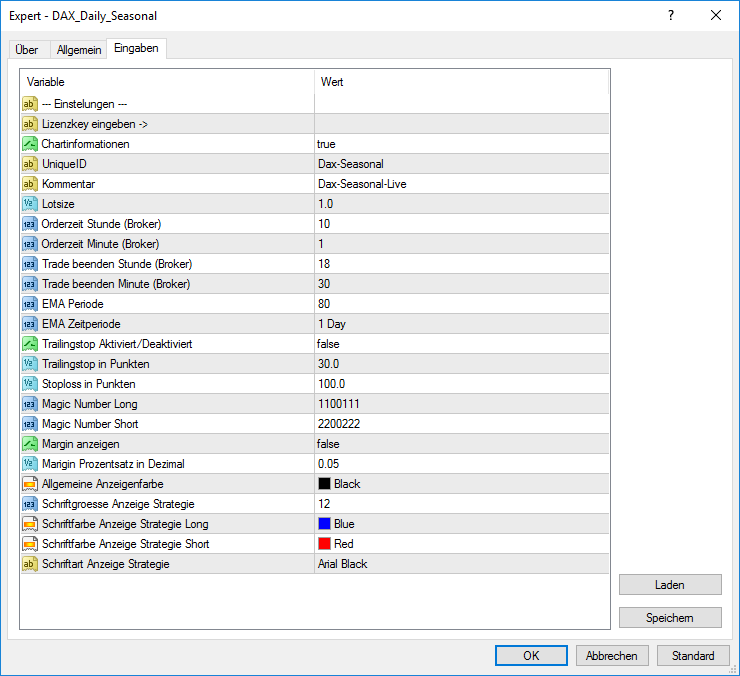

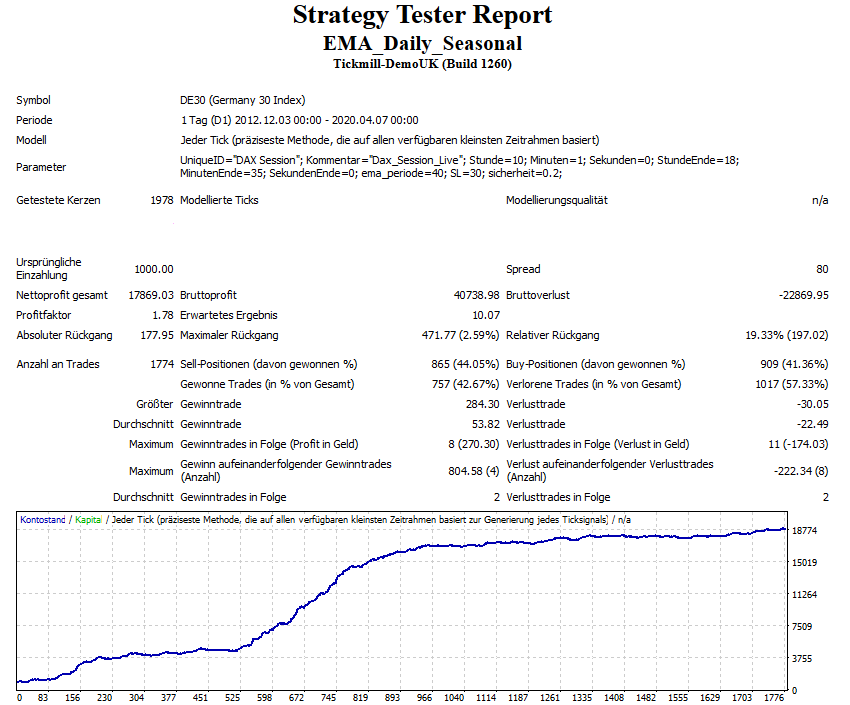

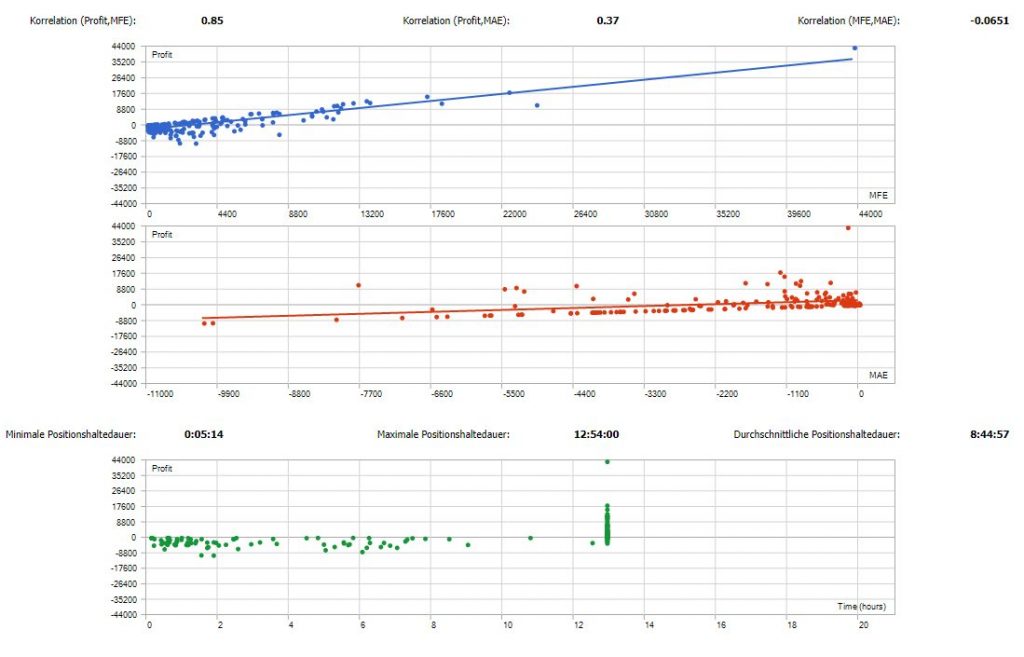

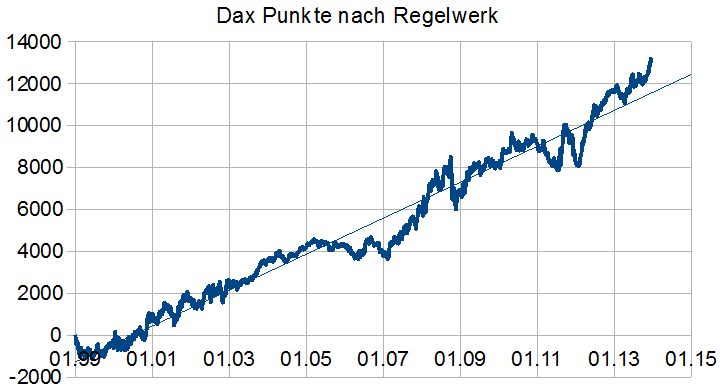

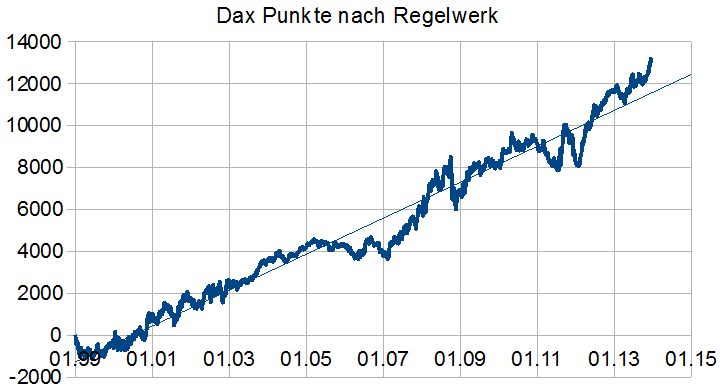

We can now perform a simple calculation using fixed rules and run a profitability analysis based on historical data. If the opening price on a given day is above the previous day’s EMA80 (=> bull market) and, for example, it’s a Monday, we open a long position and close it at the end of the day. On a Tuesday, we would open a short position at the market open (in a bull market) and close it again at the end of the day. Applying this simple rule to historical data results in the following accumulation of FDAX points.

In total, this would have collected almost 14,000 FDAX points over 14 years. Thus, a probabilistic edge turned into a real profit advantage. A more detailed analysis would, of course, include the actual spread (difference between bid and ask) and define a stop-loss for each trade. However, the basic system is impressively simple and offers plenty of potential for optimization.

The Trading Idea

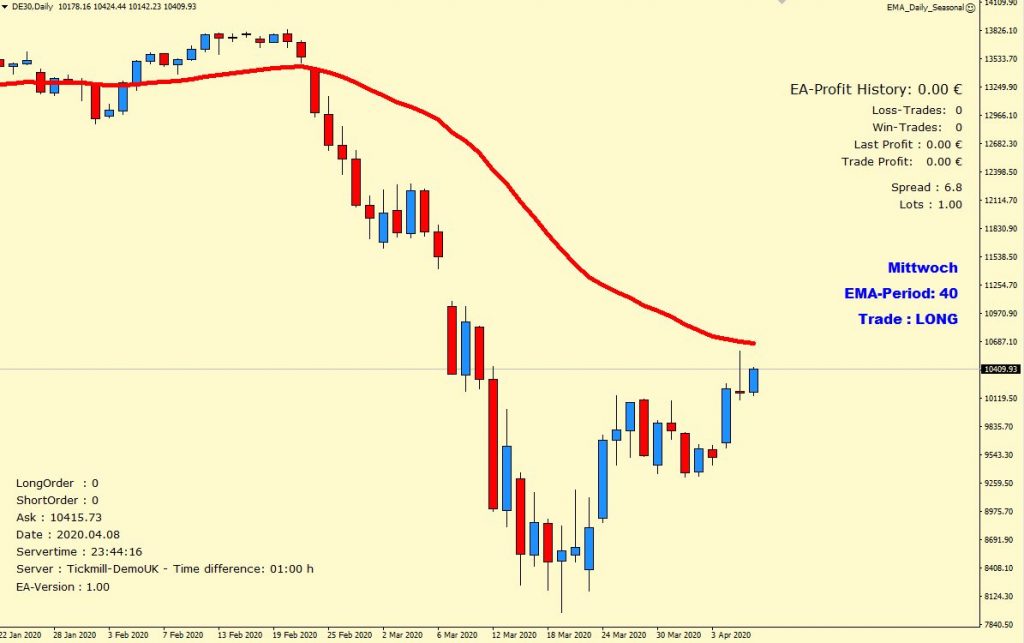

In a bull market, prices regularly rise on Monday, Thursday, and Friday, while on Tuesday and Wednesday they tend to fall. In a bear market, it is exactly the opposite.

Bull Market

If the opening price on a trading day is above the exponential moving average, we assume a bull market. Therefore, we go long on Monday, Thursday, and Friday, and short on Tuesday and Wednesday. On Monday morning, we buy a position and close it shortly before the closing bell. On the following Tuesday, expecting lower prices, we sell short. We continue to follow this plan throughout the rest of the week.

Bear Market

If the DAX opens below our trend filter, we assume a downtrend — a bear market. We apply the opposite behavior: on Monday, Thursday, and Friday, we short the market, while on Tuesday and Wednesday, we go long. Applying this simple rule to historical data should yield a profitable and stable trading system.