Setup & Indicators

- Fast EMA: Period 10

- Slow EMA: Period 50

- Timeframe: H1 or H4

- Additional filter: ATR(14) > 0.0005 for minimum volatility

Entry

- Long: EMA10 crosses EMA50 from below and ATR indicates sufficient trend strength.

- Short: EMA10 crosses EMA50 from above.

Exit & Trailing

- Stop-loss: 1.5 × ATR(14) below/above the crossover point.

- Take profit: 2 × risk (risk/reward = 1:2) or dynamically via trailing stop = 1 × ATR.

Risk Management

- Max. risk per trade: 1–2% of account equity.

- Position size: Choose volume so that SL distance × volume ≤ max risk.

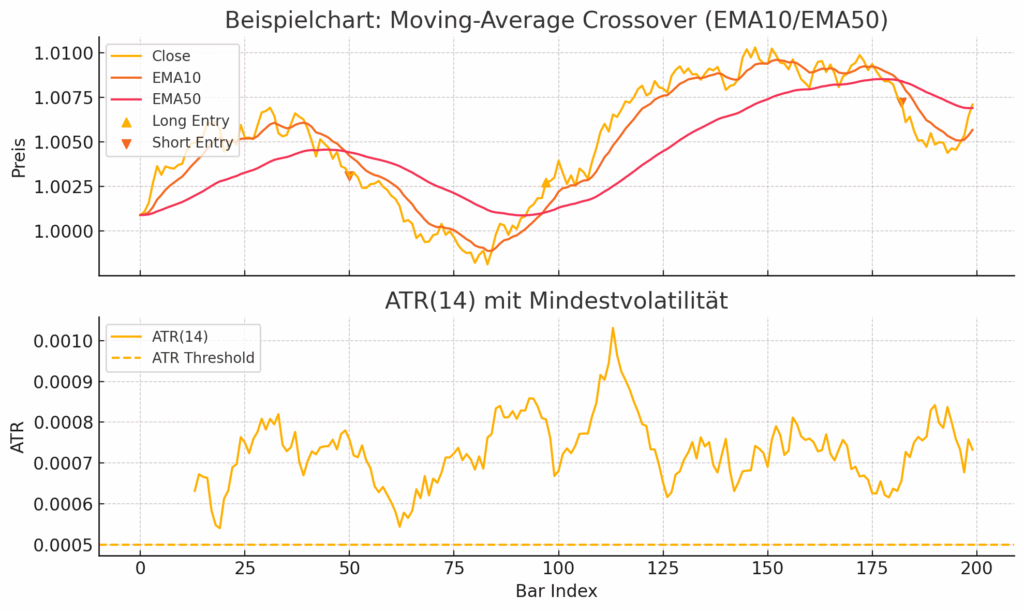

- Upper panel (price with EMAs):

- Yellow line: Close price

- Orange line: EMA10

- Red line: EMA50

- ▲ Long entry, ▼ short entry, only when ATR(14) > 0.0005

- Lower panel (ATR(14)):

- Yellow line: ATR(14)

- Dashed line: Minimum volatility (0.0005)

Chart Interpretation

- Long entry: EMA10 crosses EMA50 from below and ATR(14) is above the threshold.

- Short entry: EMA10 crosses EMA50 from above with sufficient volatility.

- Stop-loss & take profit: Based on 1.5 × ATR below/above the cross and R/R = 1:2 or ATR-based trailing.

This gives you a visual check of the setup in the H1/H4 context before applying risk management (1–2 % per trade, position sizing).