Setup & Components

- Tenkan (9), Kijun (26), Senkou Span B (52), adjust cloud colors

- Timeframe: H4/D1 for maximum significance

- Filter: Trend direction based on cloud position

Entry

- Long: Price > cloud and Tenkan crosses Kijun from below.

- Short: Price < cloud and Tenkan crosses Kijun from above.

- Note: Chikou Span (lagging line) should not be blocked by price.

Exit

- Stop-loss: Beyond the cloud edge (Senkou Span A/B) or at the Kijun level.

- Take-profit: When Tenkan/Kijun cross again or when price falls back into the cloud.

Risk Management

- Only trade in the trend direction (price not inside the cloud).

- Volume scaling: Halve position size after every second swing high/low.

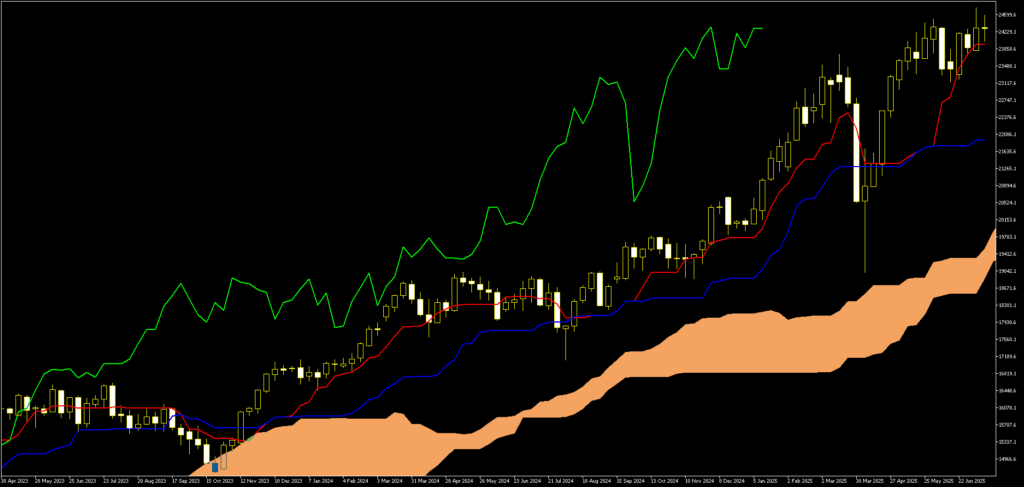

- Price (candles)

- Candlesticks on a black background show each day’s open–high–low–close.

- Tenkan-sen (9-period, red line)

- Short-term trend line, calculated as the average of the 9-period high and low.

- Kijun-sen (26-period, blue line)

- Medium-term trend line, average of the 26-period high and low.

- Senkou Span A & B (cloud, orange fill)

- Senkou A (green line): (Tenkan + Kijun)/2, shifted 26 periods forward

- Senkou B (brown line): Average of the 52-period high/low, shifted 26 periods forward

- The cloud (Kumo) is shaded orange:

- Light orange when Senkou A > Senkou B (bullish)

- Dark orange when Senkou A < Senkou B (bearish)

- Chikou Span (green lagging line)

- Today’s closing price shifted 26 periods back. Shows whether current bullish momentum is confirmed.

What the chart shows

- Overall bullish trend:

- Price remains consistently above the cloud.

- Senkou A clearly above Senkou B (light cloud).

- Tenkan and Kijun are rising.

- Entry signal (long):

- Around the blue bars (December 2023), Tenkan (red) crosses Kijun (blue) from below.

- At the time of the cross, price is already above the cloud — trend filter satisfied.

- Chikou Span runs above price and is not blocked by the cloud.

- This combination generates the marked long entry.

- Follow-through:

- After the cross, price continues higher, confirmed by rising Tenkan/Kijun and a thickening cloud.

- Several subsequent crosses on the weekly timeframe allowed new entries, while the cloud acted as dynamic support.

How to interpret this for your trading

- Trend filter: Take trades only when price & Chikou Span are clearly above (or below) the cloud.

- Entry: Tenkan/Kijun cross in the direction of the higher-timeframe trend.

- Stop-loss: Directly beyond the cloud edge (Senkou Span A/B) or at the Kijun level.

- Exit: Either on an opposite cross or on a drop back into the cloud — then close or trail the position.

The chart ideally illustrates how Ichimoku unites all key trend, momentum, and support/resistance signals in a single view.