Setup & Tools

- Fibonacci Retracement: Levels 38.2%, 50%, 61.8%

- Timeframe: H1–D1 for reliable trend phases

- Confirmation: Candlestick patterns (Pin Bar, Engulfing)

Entry

- Draw the tool from the swing low to the swing high (uptrend), or vice versa.

- Long: Price tests 50% or 61.8% and forms a bullish engulfing or hammer.

- Short: Analogous at the retracement levels in a downtrend.

Exit

- Stop-Loss: 5 pips beyond the next Fibonacci level.

- Take Profit: 100% level (swing high or low) or extensions (127.2%, 161.8%).

Risk Management

- Only take trades with confluence (e.g., overlapping trendline or MA50).

- Max. 1.5% risk per trade.

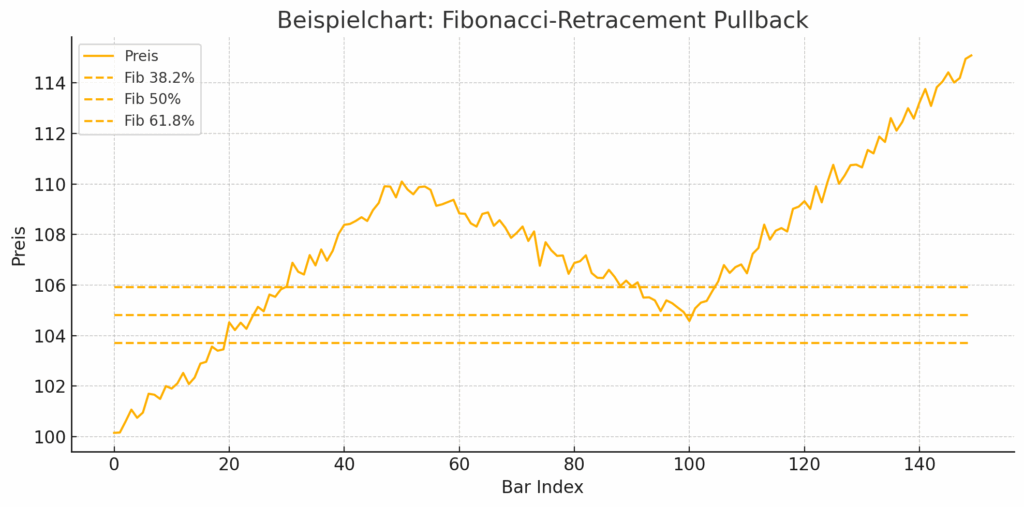

- Price action: Uptrend (bars 0–49), pullback (50–99), trend continuation (100–149).

- Fibonacci levels (between swing low at ~100 and swing high at ~110):

- Fib 38.2% (~103.82)

- Fib 50% (~105.00)

- Fib 61.8% (~106.18)

- Entry markers: ▲ Entries at the 61.8% and 50% levels once price tests and reverses with a counter move (bullish engulfing/hammer).

Legend

- Yellow line: Close price

- Dotted lines: Fibonacci levels

- ▲ Entries at retracement levels

With this example, you can identify pullbacks at key levels and deliberately wait for candlestick confirmations (e.g., hammer, engulfing). Set the stop-loss 5 pips beyond the next Fib level and take profit at the swing high or at extensions (127.2%, 161.8%).