DAX Strategy Performance Report

Performance Data and Trades 2024 - Today

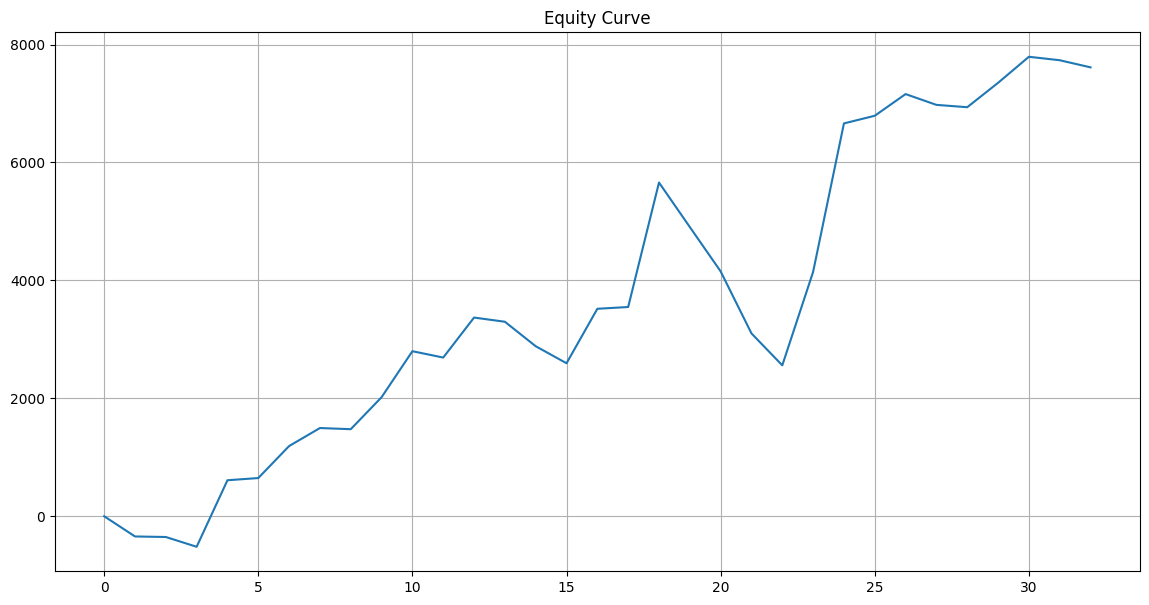

Total Trades: 37

Total Points: 6865.41

Points per Trade: 185.55

| Entry Date | Entry Price | Exit Date | Exit Price | Type | Points |

|---|---|---|---|---|---|

| 2024-01-11 | 16547.03 | 2024-01-24 | 16889.92 | Short | -342.89 |

| 2024-01-24 | 16889.92 | 2024-02-13 | 16880.83 | Long | -9.09 |

| 2024-02-13 | 16880.83 | 2024-02-15 | 17046.69 | Short | -165.86 |

| 2024-02-15 | 17046.69 | 2024-04-05 | 18175.04 | Long | 1128.35 |

| 2024-04-05 | 18175.04 | 2024-04-23 | 18137.65 | Short | 37.39 |

| 2024-04-23 | 18137.65 | 2024-05-22 | 18680.2 | Long | 542.55 |

| 2024-05-22 | 18680.2 | 2024-07-03 | 18374.53 | Short | 305.67 |

| 2024-07-03 | 18374.53 | 2024-07-18 | 18354.76 | Long | -19.77 |

| 2024-07-18 | 18354.76 | 2024-08-13 | 17812.05 | Short | 542.71 |

| 2024-08-13 | 17812.05 | 2024-09-04 | 18591.85 | Long | 779.8 |

| 2024-09-04 | 18591.85 | 2024-09-13 | 18699.4 | Short | -107.55 |

| 2024-09-13 | 18699.4 | 2024-10-23 | 19377.62 | Long | 678.22 |

| 2024-10-23 | 19377.62 | 2024-11-11 | 19448.6 | Short | -70.98 |

| 2024-11-11 | 19448.6 | 2024-11-12 | 19033.64 | Long | -414.96 |

| 2024-11-12 | 19033.64 | 2024-11-22 | 19322.59 | Short | -288.95 |

| 2024-11-22 | 19322.59 | 2024-12-17 | 20246.37 | Long | 923.78 |

| 2024-12-17 | 20246.37 | 2025-01-06 | 20216.19 | Short | 30.18 |

| 2025-01-06 | 20216.19 | 2025-03-04 | 22326.81 | Long | 2110.62 |

| 2025-03-04 | 22326.81 | 2025-03-05 | 23081.03 | Short | -754.22 |

| 2025-03-05 | 23081.03 | 2025-03-11 | 22328.77 | Long | -752.26 |

| 2025-03-11 | 22328.77 | 2025-03-18 | 23380.7 | Short | -1051.93 |

| 2025-03-18 | 23380.7 | 2025-03-26 | 22839.03 | Long | -541.67 |

| 2025-03-26 | 22839.03 | 2025-04-15 | 21253.7 | Short | 1585.33 |

| 2025-04-15 | 21253.7 | 2025-06-12 | 23771.45 | Long | 2517.75 |

| 2025-06-12 | 23771.45 | 2025-06-24 | 23641.58 | Short | 129.87 |

| 2025-06-24 | 23641.58 | 2025-07-16 | 24009.38 | Long | 367.8 |

| 2025-07-16 | 24009.38 | 2025-08-07 | 24192.5 | Short | -183.12 |

| 2025-08-07 | 24192.5 | 2025-08-26 | 24152.87 | Long | -39.63 |

| 2025-08-26 | 24152.87 | 2025-09-26 | 23739.47 | Short | 413.4 |

| 2025-09-26 | 23739.47 | 2025-10-15 | 24181.37 | Long | 441.9 |

| 2025-10-15 | 24181.37 | 2025-10-24 | 24239.89 | Short | -58.52 |

| 2025-10-24 | 24239.89 | 2025-10-30 | 24118.89 | Long | -121.0 |

| 2025-10-30 | 24118.89 | 2025-11-11 | 24088.06 | Short | 30.83 |

| 2025-11-11 | 24088.06 | 2025-11-17 | 23590.52 | Long | -497.54 |

| 2025-11-17 | 23590.52 | 2025-11-26 | 23726.22 | Short | -135.7 |

| 2025-11-26 | 23726.22 | 2025-12-17 | 23960.59 | Long | 234.37 |

| 2025-12-17 | 23960.59 | 2025-12-23 | 24340.06 | Short | -379.47 |

Entry Signals with Stop-Loss

| Date | Signal Price | Type | Stop-Loss |

|---|---|---|---|

| 2024-01-11 | 16547.03 | Sell | 16963.47 |

| 2024-01-24 | 16889.92 | Buy | 16345.02 |

| 2024-02-13 | 16880.83 | Sell | 17049.52 |

| 2024-02-15 | 17046.69 | Buy | 16831.53 |

| 2024-04-05 | 18175.04 | Sell | 18567.16 |

| 2024-04-23 | 18137.65 | Buy | 17626.9 |

| 2024-05-22 | 18680.2 | Sell | 18892.92 |

| 2024-07-03 | 18374.53 | Buy | 18030.49 |

| 2024-07-18 | 18354.76 | Sell | 18779.4 |

| 2024-08-13 | 17812.05 | Buy | 17024.82 |

| 2024-09-04 | 18591.85 | Sell | 18990.78 |

| 2024-09-13 | 18699.4 | Buy | 18208.84 |

| 2024-10-23 | 19377.62 | Sell | 19674.68 |

| 2024-11-11 | 19448.6 | Buy | 19004.97 |

| 2024-11-12 | 19033.64 | Sell | 19563.97 |

| 2024-11-22 | 19322.59 | Buy | 18812.53 |

| 2024-12-17 | 20246.37 | Sell | 20522.82 |

| 2025-01-06 | 20216.19 | Buy | 19649.87 |

| 2025-03-04 | 22326.81 | Sell | 23307.97 |

| 2025-03-05 | 23081.03 | Buy | 22235.26 |

| 2025-03-11 | 22328.77 | Sell | 23475.88 |

| 2025-03-18 | 23380.7 | Buy | 22258.3 |

| 2025-03-26 | 22839.03 | Sell | 23476.01 |

| 2025-04-15 | 21253.7 | Buy | 18489.91 |

| 2025-06-12 | 23771.45 | Sell | 24479.42 |

| 2025-06-24 | 23641.58 | Buy | 23051.55 |

| 2025-07-16 | 24009.38 | Sell | 24639.1 |

| 2025-08-07 | 24192.5 | Buy | 23380.94 |

| 2025-08-26 | 24152.87 | Sell | 24536.11 |

| 2025-09-26 | 23739.47 | Buy | 23284.67 |

| 2025-10-15 | 24181.37 | Sell | 24771.34 |

| 2025-10-24 | 24239.89 | Buy | 23684.37 |

| 2025-10-30 | 24118.89 | Sell | 24384.24 |

| 2025-11-11 | 24088.06 | Buy | 23452.89 |

| 2025-11-17 | 23590.52 | Sell | 24441.28 |

| 2025-11-26 | 23726.22 | Buy | 22943.06 |

| 2025-12-17 | 23960.59 | Sell | 24474.62 |

| 2025-12-23 | 24340.06 | Buy | 23923.97 |

Trade Analysis 1 Point = 1 €

Period: 11 Jan 2024 – 26 Sep 2025 • 29 Trades • Always in the Market

Total

Gross Profit€12,093.42

Gross Loss€4,742.88

Net PnL€7,350.54

Profit Factor2.550

Win Rate51.72%

Avg. per Trade (Expected Value)€253.47

Avg. Win / Avg. Loss€806.23 / €338.78

Payoff Ratio2.380

Best / Worst Trade€2,517.75 / −€1,051.93

Max. Drawdown (Equity)€3,100.08

Max. Winning / Losing Streak4 / 4

Total / Avg. Holding Period624 days / 21.52 days

Std. Deviation per Trade€801.59

Sharpe ≈ Mean/Std0.316

Long (14 Trades)

Net PnL€7,271.49

Win Rate57.14%

Profit Factor5.091

Avg. Win / Avg. Loss€1,131.11 / €296.23

Payoff Ratio3.818

Avg. Holding Period26.57 days

Avg. per Trade€519.39

Short (15 Trades)

Net PnL€79.05

Win Rate46.67%

Profit Factor1.027

Avg. Win / Avg. Loss€434.94 / €370.69

Payoff Ratio1.173

Avg. Holding Period16.80 days

Avg. per Trade€5.27

Summary

- Clear edge on Long side (PF 5.09; high avg. profits). Shorts are almost flat.

- Expected value ~€253 per trade with max. drawdown ~€3.1k.

- Potential improvements: ATR/Trend filter for Shorts, session filter, fine-tuning trailing and break-even.

Note

Calculated directly from the list above (29 trades). 1 point = 1 €. No fees or slippage included.